MoneyMinder Software Reviews, Demo, and Pricing in 2024.

Table of Contents

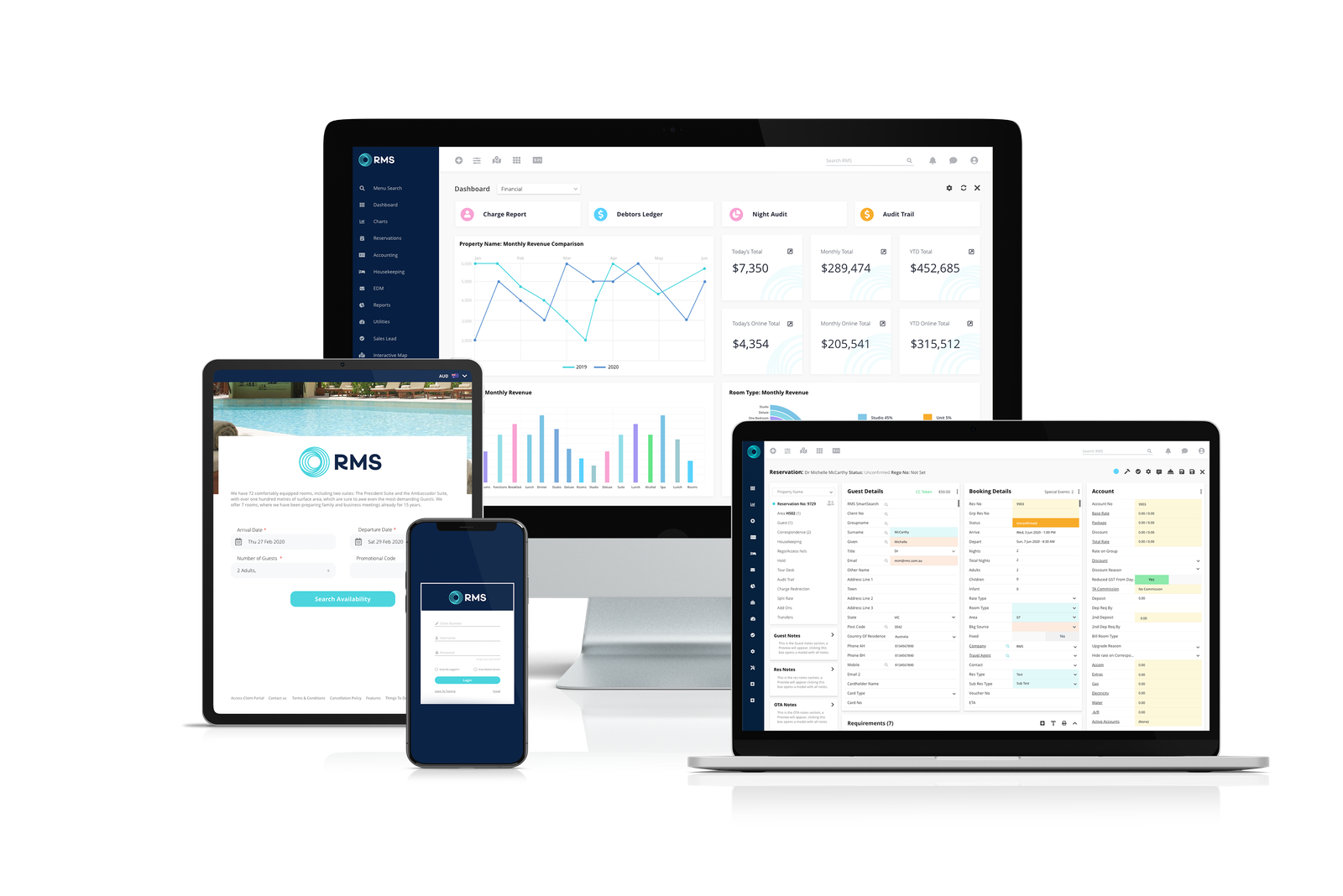

MoneyMinder is a complete nonprofit financial management software that is meant to make it easier to manage financial operations for a variety of groups. MoneyMinder gives you the tools you need to successfully manage your funds no matter if you are a member of a parent group, charity group, youth group, sporting group, homeowner organization, professional development group, religious organization, or any other type of nonprofit group.

Key Features.

TRACK BUDGETS AND EXPENSES: MoneyMinder makes it simple to create and maintain budgets. Keep track of your revenue and spending, and assign cash to various programs and activities within your business.

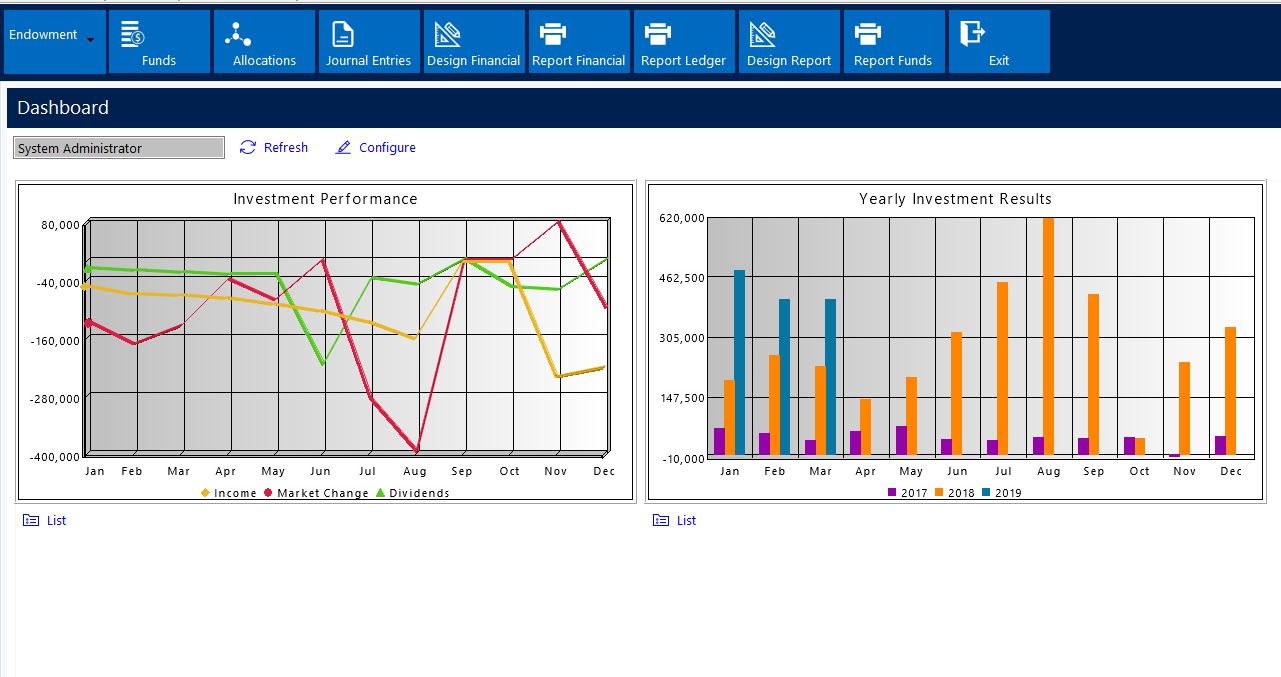

CREATE FINANCIAL REPORTS: Using customized templates and pre-built reports, you may streamline financial reporting. Create complete statements, balance sheets, and treasurer reports to receive useful insights into the financial health of your firm.

MANAGE MEMBERS: Use MoneyMinder’s powerful membership management capabilities to keep track of your organization’s members, volunteers, contacts, and donations. Save member information, manage dues, and conveniently issue reminders when necessary.

RECONCILE BANK ACCOUNTS: Using MoneyMinder’s user-friendly features, you can streamline the bank reconciliation process. Transactions are matched, accounts are reconciled, and problems are resolved swiftly, saving you time and effort.

DOCUMENT STORAGE: Say bye to your paper record. MoneyMinder allows you to securely save all of your key papers in the cloud, such as schedules of meetings, minutes, forms, regulations, IRS correspondence, invoices, and customisable templates.

CREATE AN ONLINE STORE: Generate funds easily with your personalized online store. Through an easy-to-use platform, you may sell tickets to an event, collect member dues, sell spirit wear, receive donations, acquire sponsorships, and collect trip costs. MoneyMinder accepts payments by Stripe, Paypal, Square, Venmo, credit cards, eCheck, and bank accounts.

Additional features include the ability to electronically file your tax forms, link with over 12,000 banks and prominent payment systems such as Venmo, Stripe, Square, and Paypal to automate transaction entry, and effortlessly transfer data from QuickBooks to ensure a smooth transition.

MoneyMinder is an ad-free site with no startup costs and clear pricing. You’ll also get access to US-based help anytime you need it.

Other Software Review – Realm Demo and Pricing

Pricing of MoneyMinder.

MoneyMinder’s starting price is $179/year (with a 30-day free trial). – Integration of online banking and merchant accounts – $59/year – Online Store – 0.4% per transaction

Starting price: $179.00 annually

Trial period: Available

Version for free: Not available

Check Out the Website My Tools Point For Other Information About Software and Tools.

Features

- Credit Card Processing

- For Religious Organizations

- Customizable Fields

- Forecasting

- Fundraising Management

- Data Import/Export

- Document Storage

- Fund Management

- Projections

- Planning Tools

- Payment Processing

- Online Giving

- Email Templates

- Electronic Payments

- Membership Renewals

- Pledge Management

- Financial Analysis

- Financial Reporting

- Receipt Management

- For Nonprofits

- Event Calendar

- Forms Management

- Fund Accounting

- General Ledger

- Donor Management

- Invoice Management

- Mobile Access

- Member Types

- Donation Tracking

- Expense Tracking

- Membership Management

- For Small Businesses

- Financial Management

- Profit/Loss Statement

- Member Database

Other Software Review – Aplos Demo and Pricing

Pros & Cons.

PROS.

- This software’s ease of use is ideal for persons with or without accounting knowledge. The original and ongoing customer service is excellent.

- Amazing tool, especially for tiny volunteer-run groups like ours.

- The customer service crew is OUTSTANDING. When I have a question, they answer quickly and are quite helpful.

CONS.

- Trying to find out which reports to run might be perplexing.

- The biggest disadvantage of the program was the need to import the previous year’s data into it.

Read More:- MoneyMinder